Ultimate Guide to Teeth Whitening

In a world where first impressions matter, having a bright, radiant smile can make all the difference. Teeth whitening has...

In a world where first impressions matter, having a bright, radiant smile can make all the difference. Teeth whitening has...

In today's fast-paced work environments, where employees spend long hours seated at desks, the significance of ergonomic furniture cannot be...

In a world where relationships, both personal and professional, are fundamental to our success and happiness, the concept of trust...

In the intricate tapestry of mental health, co-occurring disorders present a unique challenge. Individuals grappling with substance abuse often find...

In today's digital age, technology has infiltrated almost every aspect of our lives, and education is no exception. With the...

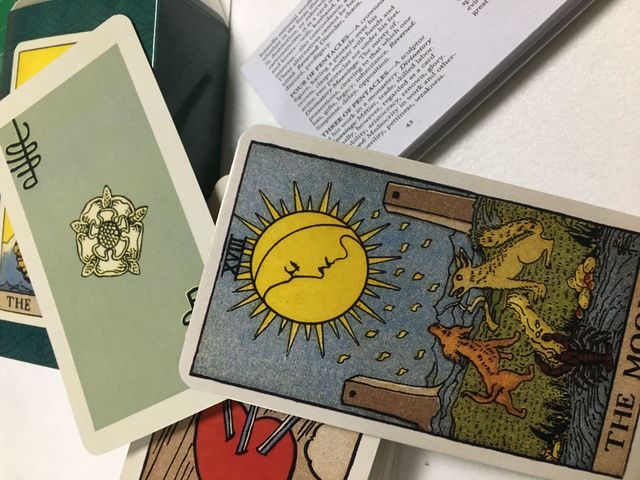

In a world filled with stress and uncertainty, people are constantly seeking ways to find solace, healing, and clarity in...

When it comes to your vehicle, few components are as crucial to your safety and performance as the tires. Your...

In today's fast-paced world, where work, social commitments, and technology often take precedence, the importance of a good night's sleep...

Emotions are an intrinsic part of the human experience, shaping our perceptions, behaviors, and overall well-being. We often consider them...

When it comes to building and maintaining healthy relationships, one crucial element stands above all others: effective communication. It is...

Dealing with day-to-day pain, either moderate or severe, endures the body in its entirety as well as an individual's spirit....

It doesn't take a rocket scientist to find out that extended sleep deprivation is a serious issue. Sleep problems reach...

I'm assuming you want to set up a firm in Dubai? Otherwise, you would certainly not be reading about this....

Do you have plans of beginning an online shop? Undoubtedly, marketing items online has a lot of advantages compared to...

I have actually obtained some intriguing emails in the past few days. Some have actually told me they are most...

There is an old expression that mentions "Cash makes the world go 'round" yet sometimes it just keeps you in...

The globe of health and fitness is loaded with misunderstandings concerning diet plans and nourishment. In this diet plan and...

Looking great does not always suggest spending a lot of money on your designer outfits and devices. One of the...

Curious about mind training programs? Is there anything to them besides smoke and also mirrors? I have actually been utilizing...

Excessive weight is a growing trouble, and science uses up much time and energy attempting to figure it all bent...

If you are seeking to start an e-commerce service, discovering a dependable decline delivery business would be your primary worry....

Purchasing wholesale presents can be a good suggestion especially when you have a long listing of individuals to keep in...

If you are ever in an automobile crash, it will certainly more than likely be a memorable and scary occasion....

Indian clothing is obtaining appeal worldwide. Indian costume options have actually always wooed males and females across the globe with...

You can formulate a terrific return on your residence renovation funds in the kitchen area. There are certain restorations that...